There are rules for success and there are reasons for failure. In the world of trading and investing, it is no different. Here are the 3 rules that make up 100% of your success:

- Strategies

- Money Management

- State of Mind

1. Strategies

Strategies deal with how you are buying, selling or even staying out. As a general rule, we buy low and sell high. If we buy a pair of shoes at $100 and sell it at $150, we make a profit of $50. This is how profit is generated.

There are many different types of strategies. Here’s some common ones:

- Technical (chart-based)

- Fundamental (economy-based)

- Value investing (seeking undervalued assets)

Even as an entrepreneur, you have to deploy the right strategy for your start-up. You need to think about whether your start-up has proven models before you or whether you have the first-mover advantage. Only then can you appropriate the right strategy to gain market share.

2. Money Management

One of the world’s richest investors, Warren Buffett, has been quoted multiple times with his famous “two rules”:

Rule #1 – Don’t lose money

Rule #2 – See rule number 1

Here’s another example to show how important money management is:

Let’s say you start with a capital of USD10,000. When you lose USD5,000 of your capital, you have lost 50%. However, to bring your capital back up from USD5,000 to USD10,000, you would have to make 100%.

Essentially, the money management rule is this: it’s very easy to lose money. It’s twice as difficult to make it back.

There are several facets of money management in trading and investing. Examples include:

- Lot size (how big are you going to trade/invest)

- Risk tolerance (how much are you willing to lose)

- Profit taking (what are the rules to take your profit)

- Growth (how do you compound your capital)

Money management is also very important in managing a business or investing in one. Areas to consider are:

- Payout (what is the rate of return as an investor, or what is the return on equity as a business-owner)

- Liquidity (how much funds do you have to invest)

3. State of Mind

Your state of mind is made up of your beliefs and your emotions. Primarily, they fall into 4 categories:

- Fear

- Hope

- Greed

- Ignorance

As we are emotional creatures, it is imperative to draw up a set of finance/business/investing rules for yourself based on your personality to prevent the above-mentioned emotions from derailing you.

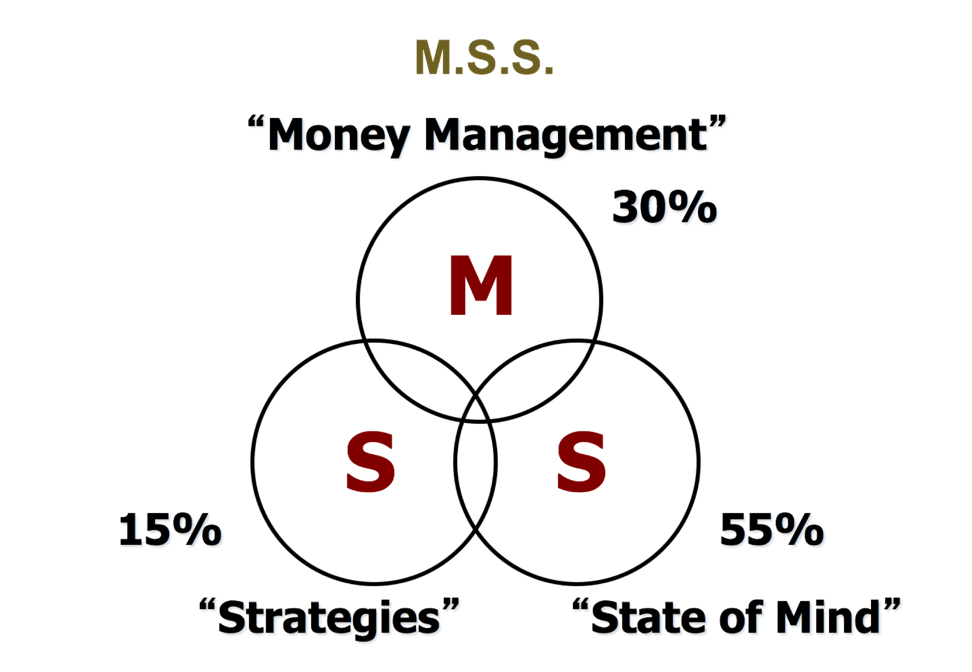

Finally, here’s a diagram to frame-up the level of importance for each category:

In short, Money Management is twice as important as Strategies and State of Mind is twice as important as Money Management.

To Your Success,

Mario